Bears are across the martket, and selling Credit Spreads is what I have been trying all week, but either my strikes were too far or I was asking for too much premium. At the end no Call Spread is added to my portfolio. However I have added a preatty out of the money Put Spread on SPX Nov15 1560/70 for 0.40.

The portfolio still up +5.785% YTD while SPX is down -6.20%. The week has been very bearish but not in panic mood. SPX is down -1.36% week and RUT a big -3.77% down for the week.

We have now 3 open positions each Oct, Nov and Dec expiries. All looking safe over 89% prob of succeed, hopefully we will not have to adjust this week any of them.

SPX is heading South along with VIX heading North. VIX is rebounding at support zone

SPX could be in the road to 1740 target, as Fib Expansion from the 2000 retracement zone

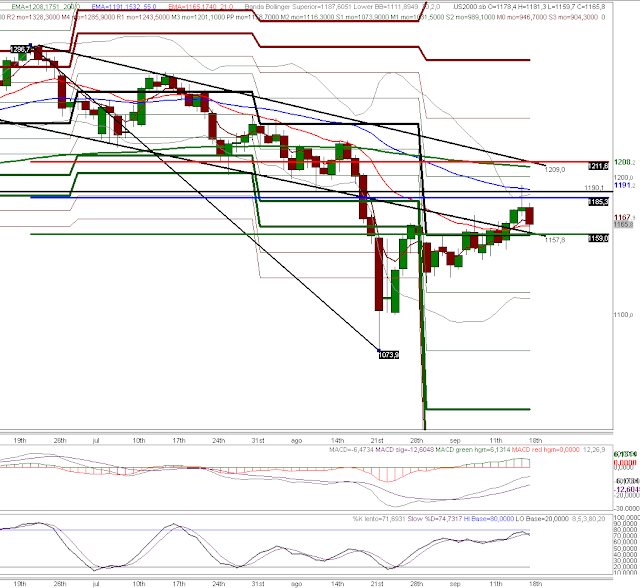

SPX Weekly Chart

Russell is looking even more Bearish, with a first target to 1075.

sábado, 26 de septiembre de 2015

domingo, 20 de septiembre de 2015

Weekly Portfolio Analysis 20th Septemeber 2015

Spain just won the EuroBasket and need to thank this wonderful team for bringing the cup once more time, thank you guys you are incredible, in the game and out the arena.

September cycle is finally over, and we have suffeedr a lot the last 4 weeks. The portfolio gets a red -2.59% for the month. However still a decent year, The Portfolio is up +5.785% for 2015 while the SPX has a poor -4.90%.

I'm looking to add positions in Octuber and November. Defently is the right time for a November Iron Condor, looking both SPX lets say 2120 - 1670 and RUY 1240 - 980.

Also looking to get filled on Oct Call Spreads. I have been trying RUT 1270/80 Nov15 but have not been filled.

Our outstanding positions are as follows:

Just 2 positions in the books

Octuber15 SPX 1775/1785 has 89% prob ending out of the money, so no concern here

December15 RUT 940/930 has 92% prob ending out the money, as well no concern so far.

Markets are still in Risk off mood. I still see bearish on the charts in the shot term. Index VIX still look high at 22.8.

RUT and SPX are still moving on the Fib retracements of the bearish movement down.

SPX has resistance at 2000 and first support at 1900.

Same Russell 2000, with big resistance at 1190

@bellinimarkets.com

September cycle is finally over, and we have suffeedr a lot the last 4 weeks. The portfolio gets a red -2.59% for the month. However still a decent year, The Portfolio is up +5.785% for 2015 while the SPX has a poor -4.90%.

I'm looking to add positions in Octuber and November. Defently is the right time for a November Iron Condor, looking both SPX lets say 2120 - 1670 and RUY 1240 - 980.

Also looking to get filled on Oct Call Spreads. I have been trying RUT 1270/80 Nov15 but have not been filled.

Our outstanding positions are as follows:

Just 2 positions in the books

Octuber15 SPX 1775/1785 has 89% prob ending out of the money, so no concern here

December15 RUT 940/930 has 92% prob ending out the money, as well no concern so far.

Markets are still in Risk off mood. I still see bearish on the charts in the shot term. Index VIX still look high at 22.8.

RUT and SPX are still moving on the Fib retracements of the bearish movement down.

SPX has resistance at 2000 and first support at 1900.

Same Russell 2000, with big resistance at 1190

@bellinimarkets.com

Suscribirse a:

Entradas (Atom)