2016 is over, and the Russell 2000 emerge as the winner in terms of performance: +19.48%.

SPX up +9.54 has nothing to complain either. But the year has been tough for trading, Brexit, Trump too much noise to make clean decisions.

2016 started badly, 22 days in the new year and the market was moving down shaprly -10%. The move made me defending my Put Spreads and acepting big losses for January and February. I did not play smartly enough as I did load myself with more Put Spreads further down but not enough to minimise most of the losses.

And from the minimum 1800 we reached 2100 in less than 2 months, +16.5% . Then sideways movements ended in Brexit shock. The Shock was the post rally, that harmed all the Call Spreads positions. But the worst was about to come when post Trump elections rally +8 up in 4 weeks.

So most of the time we have been on overbought conditions making it hard for selling Put Spreads and temping for dangeroues Call Spreads. Bellini ends the year with a dissapointing +3.045% performance.

Looking at the charts I believe there is still room to keep moving up. SPX predict has a target of 2350. And Russell has a 1420 target for 2017.

Monthly Charts

Weekly Charts

Wish you all the best for 2017!!!

sábado, 31 de diciembre de 2016

domingo, 11 de diciembre de 2016

Weekly Portfolio Analysis 11 December 2016

Not an easy Sunday, the SPX is in free upward movement, an my Call Spreads should have been defended 4 days ago.

I closed January Put Spread for 0.15 strike 1800/1825. Thus making a profit for December 1.56%.

However Call Spread 2275/2300 January is nearly at the money. I could close it at 11 making a loss of around 2,200$ (5.15% of the account). In order to erase the losses will try to sell CS Dec30th 2330/2340 and PS 2160/70.

SPX has no resistance till get to 2300 fib extention from last retracement

I closed January Put Spread for 0.15 strike 1800/1825. Thus making a profit for December 1.56%.

However Call Spread 2275/2300 January is nearly at the money. I could close it at 11 making a loss of around 2,200$ (5.15% of the account). In order to erase the losses will try to sell CS Dec30th 2330/2340 and PS 2160/70.

SPX has no resistance till get to 2300 fib extention from last retracement

lunes, 5 de diciembre de 2016

Weekly Portfolio Analysys 4th December 2016

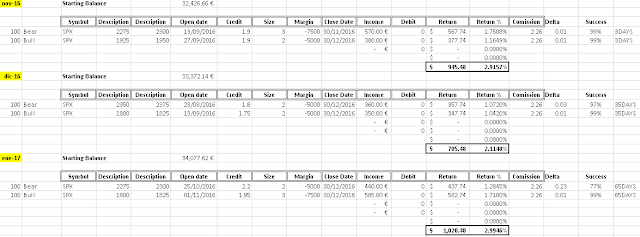

We cashed in the full premium on the Nov Options making our portfolio green for the year 2016 at +3.251% after commissions. Far away from the +7.24% SPX and +15.70% RUT.

We entered a new position on Feb29th a Call Spread 2325/2350 3 lots at 2 premium.

Our portfolio looks currently safe, thinking on closing the PS at minimum cost

Will not enter a Feb PUT SPREAD till dont see an oversold market on the stochastics

We entered a new position on Feb29th a Call Spread 2325/2350 3 lots at 2 premium.

Will not enter a Feb PUT SPREAD till dont see an oversold market on the stochastics

domingo, 27 de noviembre de 2016

Weekly portfolio Analysis 27th November 2016

Against the odds the US Index maintain their bullish momentum.

But nothing will keeps moving up forever. That makes a threat to our Call Spreads January 2275/2300 at 23 Deltas.

Next weekend November cycle will be over, and portfolio would show a modest +3.25% returned if it is compared to SPX +8.29% and the amazing RTY +18.60% YTD.

On our portfolio everythig looks safe apart from the january Call Spread. I think could be now a good spot to close both Dec and Jan 1800/25 Put Spreads.

The SPX Index is in free raise, there is nothing to stop it, apart from a healthy movement of consolidation needed. My objetive is to reach 2300 in the following weeks.

But nothing will keeps moving up forever. That makes a threat to our Call Spreads January 2275/2300 at 23 Deltas.

Next weekend November cycle will be over, and portfolio would show a modest +3.25% returned if it is compared to SPX +8.29% and the amazing RTY +18.60% YTD.

On our portfolio everythig looks safe apart from the january Call Spread. I think could be now a good spot to close both Dec and Jan 1800/25 Put Spreads.

The SPX Index is in free raise, there is nothing to stop it, apart from a healthy movement of consolidation needed. My objetive is to reach 2300 in the following weeks.

domingo, 13 de noviembre de 2016

Weekly Portfolio Analysis 13th November 2016

Trump is the new president of the greatest nation in earth and the US markets are .... going UP. After the initial shock in the rest of the world the US has experienced a non seen strength ever. Russell 2000 is up 12% YTD after a 10% raise this week!!!

Our 3 Iron Condors are all looking good apart form the Call side on the January31th 3 SPX 2275/2300 showing a small lost at 14 Deltas.

$VIX has experience big volatility lately, and might continuous this path in the weeks ahead.

Now show low volatility again, perfect zone to start raising once more time.

The chart of the year on my opinion is $RUT. Not only shows a 12% raise YTD, looking at the weekly chart I wo'nt be surprise if in 2017 confirms this HCH and get to 1450 levels projection.

Our 3 Iron Condors are all looking good apart form the Call side on the January31th 3 SPX 2275/2300 showing a small lost at 14 Deltas.

$VIX has experience big volatility lately, and might continuous this path in the weeks ahead.

Now show low volatility again, perfect zone to start raising once more time.

domingo, 16 de octubre de 2016

Weekly Portfolio Analysis 16th October 2016

Markets closed on red for abother week in a row. SPX is +4.36% up and RUT +6.74%. SPX has found support again on the 2120.

Our opened positions all look safe showing all Deltas less than 10. We will not do any more trades until next week if we dont see a panic seller during the week.

SPX and RUT on support, if broken we will see further movement down on the weeks ahead.

Our opened positions all look safe showing all Deltas less than 10. We will not do any more trades until next week if we dont see a panic seller during the week.

SPX and RUT on support, if broken we will see further movement down on the weeks ahead.

sábado, 8 de octubre de 2016

Weekly Portfolio Analysis 8th October 2016

NFP slightly lower than expected, will rates be move up in November? December? As an options seller dont really care as long as markets move in a smoothly way.

Position are looking safe, hope not to do any trading next week. Once we cash in October CS Premium would be time for entering first 2017 trade.

Markets are still moving in this summer range and no man's land

Position are looking safe, hope not to do any trading next week. Once we cash in October CS Premium would be time for entering first 2017 trade.

Markets are still moving in this summer range and no man's land

sábado, 1 de octubre de 2016

Weekly Portfolio Analysis 1st Octuber 2016

First 3 quarters of 2016 are over, and our Bellini performance show a negative -0.843, badly if we compare to +6.08% SPX and +10.19% RUT.

I am feeling confident markets will behave in a low volatility environment so we still have time to end the year on a more decent performance

I enetered a new November position on Selling 2 Nov30th PUT SPREAD 1925/50 (I wanted to sell 3 tho) in order to compleate an Iron Condor

All positions are less than 10 Deltas and looking healthy. Dont expect to add any new trade this week,

I am feeling confident markets will behave in a low volatility environment so we still have time to end the year on a more decent performance

I enetered a new November position on Selling 2 Nov30th PUT SPREAD 1925/50 (I wanted to sell 3 tho) in order to compleate an Iron Condor

All positions are less than 10 Deltas and looking healthy. Dont expect to add any new trade this week,

domingo, 25 de septiembre de 2016

Weekly Portfolio Analysis 25th September 2016

FED did not move the interest rates, as most analysits expected. Thant helped to move the markets.. up. till touched resistance. So now lets see where markets move next.

We dindt open any new trade this week, would like to add a Put Spread November in the portfolio on the 1875 ish. Our current open position all look safe.

Vix has dropped dramatically lately, making now tough to open new positions.

SPX has a strong support at 2120 and looks more likely to keep on the bull side, with permission of the highs registered over summer time.

We dindt open any new trade this week, would like to add a Put Spread November in the portfolio on the 1875 ish. Our current open position all look safe.

Vix has dropped dramatically lately, making now tough to open new positions.

domingo, 18 de septiembre de 2016

Weekly Portfolio Analysis 18 September 2016

We had another volatil week compared to the range whre SPX has been moving since July. Expected for the September expiry to move a bit.

I enetered new positions this week taking advantage of the volatility

All my positions now look OK with Deltas bellow 10, and I have added a Put Spread Dec to the portfolio balancing the positions

The only trade I would like to enter is a Put Spread on November cycle if the index falls this week.

SPX looks like a Pull Back formation, has found support where months ago had resistance

I enetered new positions this week taking advantage of the volatility

All my positions now look OK with Deltas bellow 10, and I have added a Put Spread Dec to the portfolio balancing the positions

The only trade I would like to enter is a Put Spread on November cycle if the index falls this week.

SPX looks like a Pull Back formation, has found support where months ago had resistance

domingo, 4 de septiembre de 2016

Weekly Portfolio Anaylis 4rd September 2016

Markets keep going high, and there is nothing to stop them yet. Also there is a lor of room to correct, but with VIX at lows is hard to open new strategies.

We cashed in the 2 Aug31st SPX 2250/75 for full premium, and our Portfolio is still on the negative -0.843%

Our current open positions look OK, dont think we will go up for ever so in next correction we could look to open new PS and releive some of the CS

Markets are looking still oversold, so a correction before keeping heading norh would be rather healthy for the markets.

We cashed in the 2 Aug31st SPX 2250/75 for full premium, and our Portfolio is still on the negative -0.843%

Our current open positions look OK, dont think we will go up for ever so in next correction we could look to open new PS and releive some of the CS

Markets are looking still oversold, so a correction before keeping heading norh would be rather healthy for the markets.

domingo, 28 de agosto de 2016

Weekly portfolio Analysis 28th August 2016

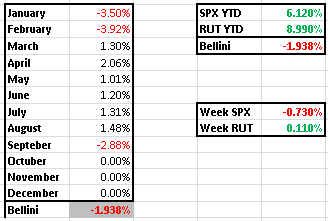

Markets made a halt in their way up after Yellen spoke. Not that much, SPX is down just -0.73% in the week but looks like a bigger one agter the past low volatility.

Our portfolio performance still lags behing major index with a -1.838% compared to the +6.12% on SP500

In 3 days we will get full premium on the Aug CS 2250/2275. but still will be in negative performance

We opened a new position on Monday on December cycle

Our current positions looks ok, if we see more dounside this week markets will be oversold and we would see opening PS

The markets are in no mans land, moving on a narrow range, still think a correction would be healthy to continiuous the bull mission.

Our portfolio performance still lags behing major index with a -1.838% compared to the +6.12% on SP500

In 3 days we will get full premium on the Aug CS 2250/2275. but still will be in negative performance

We opened a new position on Monday on December cycle

Our current positions looks ok, if we see more dounside this week markets will be oversold and we would see opening PS

The markets are in no mans land, moving on a narrow range, still think a correction would be healthy to continiuous the bull mission.

domingo, 21 de agosto de 2016

Weekly Portfolio Analysis 21th August 2016

Markets are finding hard to keep moving up, but are not falling dow either. VIX is at its lows yet making really hard to get decent premiums in new positions

SPX is +6.85% and RUT +8.88% YTD 2016. Very decent returns. On the other hand my Bellini portfolio is down -1.938%

In ten days time looks like I will receive full credit on the CCS 2250/75, and the Oct 2275/2230 looks safe for the time being.

Looking to the SPX and RUT looks like is finding some resistance although I believe 2300 will be touch sooner than later.

I would like to exploring opening positions on SPX 1950/2350 IC zones, but due to low ViX I would have to look further on time strikes. On RUT looking strikes 1100/1350

SPX is +6.85% and RUT +8.88% YTD 2016. Very decent returns. On the other hand my Bellini portfolio is down -1.938%

In ten days time looks like I will receive full credit on the CCS 2250/75, and the Oct 2275/2230 looks safe for the time being.

Looking to the SPX and RUT looks like is finding some resistance although I believe 2300 will be touch sooner than later.

I would like to exploring opening positions on SPX 1950/2350 IC zones, but due to low ViX I would have to look further on time strikes. On RUT looking strikes 1100/1350

domingo, 14 de agosto de 2016

Weekly Portfolio Analysis 14th August 2016

After 3 weeks badly manageing the Sep 2225/50 CS finally stopped out at 6.70.

Portfolio Bellini YTD has a negative -2.233% performance 2016, wide behind major indices.

Markets did not move much this summer week. With VIX on very low zones makes difficult to sell Spreads, but will try and find well OTM to get some return this year.

Next Friday we would, hopefully, get full premium on the RUT CS 1270/80 and end of month hopefully the CS 2250/75

SPX still look very bullish and aiming to 2300

Portfolio Bellini YTD has a negative -2.233% performance 2016, wide behind major indices.

Markets did not move much this summer week. With VIX on very low zones makes difficult to sell Spreads, but will try and find well OTM to get some return this year.

Next Friday we would, hopefully, get full premium on the RUT CS 1270/80 and end of month hopefully the CS 2250/75

SPX still look very bullish and aiming to 2300

Suscribirse a:

Entradas (Atom)