And the Xmas rally is here at least!! the markets soared this week making the SPX up +2.76% and the RUT +2.77%. Yield to date SPX is up 0.10% and RUT -4.15%. With only 5 days remaining to year end Bellini is up +9.72% before comissions.

Currently there is only 2 positions opened, both PS on SPX and RUT. Looking good with no concern over 98% probability of success

Markets are in no man land, so we will try to open Feb16 positiones with Iron Condors well OTM

Both SPX and RUT seem to be moving inside a range market.

domingo, 27 de diciembre de 2015

domingo, 13 de diciembre de 2015

Weekly Portfolio Analysis 14th December 2015

Markets falling sharply, commodities plumbing? Yellen about to raise interest rates? we don't know the reason but we do know we are on an oversold market after Friday plunged. monday will fall again and hopefully will add Feb OTM put spreads to the box.

Last week we took 2 new positions during the week on January 16 cycle and close with profit a Call Spread.

The S&P 500 went down -3.79% thist week to 2012, YTD -2.26%. And Russell 2000 went down -5.05% making a YTD to -6.73%. Our Bellini portfolio is up +7.85%

There is only 5 days left for December positions expires OTM and the three positions look compleatly safe, and luckily will add +1.39% to the yield portfolio for 2015.

For 2016 positions we need to be on alert as this markets falling sharply could make us defend some of the trades. Although also I see a good oportunity to sell out of the money Feb16 positions.

We already profited +1.06% closing the 2230/40 CS SP500 on 0.1 debit for a nice total 0.7 premium.

We have now opoened:

PS 1850/60 SPX at 0.6 with Delta 17 and 83% prob of ending OTM

PS 1000/10 RUT at 0.6 with Delta 11 and 89% prob of ending OTM.

Looking at the markets we see the VIX soaring, just as it did at the end of summer, showing might have be more trouble ahead.

SPX is about to be on oversold according to Stochastics and will fave soon the 2000 support.

RUT is already on oversold might find next support at 1100.

@bellinimarkets.com

Last week we took 2 new positions during the week on January 16 cycle and close with profit a Call Spread.

The S&P 500 went down -3.79% thist week to 2012, YTD -2.26%. And Russell 2000 went down -5.05% making a YTD to -6.73%. Our Bellini portfolio is up +7.85%

There is only 5 days left for December positions expires OTM and the three positions look compleatly safe, and luckily will add +1.39% to the yield portfolio for 2015.

For 2016 positions we need to be on alert as this markets falling sharply could make us defend some of the trades. Although also I see a good oportunity to sell out of the money Feb16 positions.

We already profited +1.06% closing the 2230/40 CS SP500 on 0.1 debit for a nice total 0.7 premium.

We have now opoened:

PS 1850/60 SPX at 0.6 with Delta 17 and 83% prob of ending OTM

PS 1000/10 RUT at 0.6 with Delta 11 and 89% prob of ending OTM.

Looking at the markets we see the VIX soaring, just as it did at the end of summer, showing might have be more trouble ahead.

SPX is about to be on oversold according to Stochastics and will fave soon the 2000 support.

RUT is already on oversold might find next support at 1100.

@bellinimarkets.com

domingo, 29 de noviembre de 2015

Weekly Portfolio Analysis 24th november 2015

Markets are quiet, good for theta SPX ended the week at 2090.5 after a +0.05% for the week. RUT closed at 1202.70 gaining a good and decent +2.32%. YTD the SPX is +1.52% and RUT is -0.19%. Our Bellini portfolio is up +7.85% with just 20 days for December expiration and end of year trading.

Our open positions look as follows:

All positions look safe, with very lows Deltas.

On Dec expiries no concern,

and on Jan16 CS 2230/40 at 0.8 with Delta 8 still looking good.

Would like to add a PS on Jan16 if we get and oversold position any time. We missed the opportunity markets gave us 12 days ago with SPX near 2000.

SPX looks moving on a range now, I would not be surprise to see the index moving further up.

RUT is finding resistance at 1200, psycological number and previous resistance. I see the index moving up as well in the following weeks.

Our open positions look as follows:

All positions look safe, with very lows Deltas.

On Dec expiries no concern,

| PS RUT | 930 | 940 | 05/10/2015 | 0.8 | Delta 1 |

| CS RUT | 1270 | 1280 | 08/10/2015 | 0.702 | Delta 2 |

| CS SPX | 2200 | 2210 | 08/10/2015 | 0.5 | Delta 6 |

and on Jan16 CS 2230/40 at 0.8 with Delta 8 still looking good.

Would like to add a PS on Jan16 if we get and oversold position any time. We missed the opportunity markets gave us 12 days ago with SPX near 2000.

SPX looks moving on a range now, I would not be surprise to see the index moving further up.

RUT is finding resistance at 1200, psycological number and previous resistance. I see the index moving up as well in the following weeks.

domingo, 8 de noviembre de 2015

Weekly Portfolio Analysis 8th November 2015

Markets still incredibly bullish makes SPX green for 5th week in a row. After not having a single Credit Call Spread I overload my portfoluio with them on the bullish maket ever! Terrible timing, and completly misjudged its direction.

Look this SPX weekly chart, no doubts:

This week the SPX moved up +0.95% and the RUT a hugh jump up +3.26%. YTD the SP500 is now positive for the year +1.96% and Russell 2000 -0.41%. Our Bellini portfolio is up +4.856%.

I traded another Dec15 Call Spread, SPX 2200/10 that looks now too close to current prices for 0.5 credit.and Delta 7

The rest of the portfolio stays as last week.

November: 12 days left for expiration

SPX 1560/70 nothing to say.

RUT 1240/50 is looking very dangerous at current 1200 RUT level. Delta is 9 but if we have another spike in the index will need to be defended and is a shame at 2 weeks to be a winner.

December; 41 days left

RUT 930/940 no concerns

RUT 1270/80 still looking ok but the Index is waken up. Delta 3, 97% prob expires out of the money.

SPX 2200/20 93% prob of success

January 2016

SPX 2230/2240 just 87% ending succesful

The markets looks as follow

SPX is finding resistance at current levels, how erver after Friday SPX has gain momentum

RUT, incredible bullish both monday and Friday, looks like 1200 is about to be smashed

My plans for the week defend positions accordingly

@bellinimarkets

Look this SPX weekly chart, no doubts:

This week the SPX moved up +0.95% and the RUT a hugh jump up +3.26%. YTD the SP500 is now positive for the year +1.96% and Russell 2000 -0.41%. Our Bellini portfolio is up +4.856%.

I traded another Dec15 Call Spread, SPX 2200/10 that looks now too close to current prices for 0.5 credit.and Delta 7

The rest of the portfolio stays as last week.

November: 12 days left for expiration

SPX 1560/70 nothing to say.

RUT 1240/50 is looking very dangerous at current 1200 RUT level. Delta is 9 but if we have another spike in the index will need to be defended and is a shame at 2 weeks to be a winner.

December; 41 days left

RUT 930/940 no concerns

RUT 1270/80 still looking ok but the Index is waken up. Delta 3, 97% prob expires out of the money.

SPX 2200/20 93% prob of success

January 2016

SPX 2230/2240 just 87% ending succesful

The markets looks as follow

SPX is finding resistance at current levels, how erver after Friday SPX has gain momentum

RUT, incredible bullish both monday and Friday, looks like 1200 is about to be smashed

My plans for the week defend positions accordingly

@bellinimarkets

domingo, 1 de noviembre de 2015

Weekly Portfolio Analysis 2nd november 2015

SPX made a stong move up after FED words and end the week falling a bit makeing a +0.20% week, while RUT fall -0.36%.

As SPX kept on the raise I decised to adjust th call spred Dec15 2155/65 for a lost 1.9 (Sold this for 0.8 credit October 8th.) So 1.1 lost here, the Delta was at 20 but was not happy with the state of the bull force so wanted to close it before getting in real trouble.

So YTD the SP500 is up +0.20%, Russell 2000 is down -3.56% and our Bellini portfolio is up just +4.8557%.

I am convinced to open a new Dec15 Iron Condor to offset most of the lost, and try to safe the year with an OK result. So aiming to get a 0.80 premium on 2200/2210 1870/1880 IC.

I also opened fris new position on 2016, a CCS Jan16 SPX 2230/2240 for 0.80 with a 6 Delta

So currently positions look now safe over 90% probability of ending out of the money.

November, with 20 days left, we got SPX 1560/1570 no concern, and RUT 1240/1250 looking good at Delta 4 and index current 1161 level.

December, with 49 days left after the adjustment is left with IC Russell 930/40 1270/80 and Delta 3.

January, 77 days left SPX 2240/30 and Delta 6, still too long in time to know how would it work.

VIX is showing low volaitility and would not be surprise to see bouncing up a bit next weeks

SPX is overbought and would make a rest soon, for the time being it looks very stong and ready to get to all time highs

On the other hand Russell 2000 has been lagging behind and trading bellow resistance at 1180

As SPX kept on the raise I decised to adjust th call spred Dec15 2155/65 for a lost 1.9 (Sold this for 0.8 credit October 8th.) So 1.1 lost here, the Delta was at 20 but was not happy with the state of the bull force so wanted to close it before getting in real trouble.

So YTD the SP500 is up +0.20%, Russell 2000 is down -3.56% and our Bellini portfolio is up just +4.8557%.

I am convinced to open a new Dec15 Iron Condor to offset most of the lost, and try to safe the year with an OK result. So aiming to get a 0.80 premium on 2200/2210 1870/1880 IC.

I also opened fris new position on 2016, a CCS Jan16 SPX 2230/2240 for 0.80 with a 6 Delta

So currently positions look now safe over 90% probability of ending out of the money.

November, with 20 days left, we got SPX 1560/1570 no concern, and RUT 1240/1250 looking good at Delta 4 and index current 1161 level.

December, with 49 days left after the adjustment is left with IC Russell 930/40 1270/80 and Delta 3.

January, 77 days left SPX 2240/30 and Delta 6, still too long in time to know how would it work.

VIX is showing low volaitility and would not be surprise to see bouncing up a bit next weeks

SPX is overbought and would make a rest soon, for the time being it looks very stong and ready to get to all time highs

On the other hand Russell 2000 has been lagging behind and trading bellow resistance at 1180

domingo, 18 de octubre de 2015

Weekly Portfolio Analysis: 18th Octuber 2015

SP 500 (+0.90) has performed better this week that the Russell 2000 (-0.26%)

YTD the SPX is down -1.25% and the RUT -3.52%. On the other hand our Bellini portfolio is up +6.56% after the Octuber cycle expired giving us 0.66%

We have not opened new trades during the week. And we will stay this while the SPX shows strengh as we might need to adjust some of the Call Spreads on the weeks ahead.

Right now the only positions that concerns me a bit is

RUT 1240/50 Nov15 with delta 0.04 and 96% prob of success.

All the positions are over 90% prob of ending out the money so would say we are in a safe poisition.

VIX keeps loosing value sharply and getting in to the zone where has been most of 2015.

SPX has been relatively strong at the end of the week, showing a non expected strengh on these short time overbought extreme. Has done a higher high and will find resistance at 2050.

RUT on the other hand is not doing higher highs and is behaving as sideways as we want it. First resistance is 1180

domingo, 11 de octubre de 2015

Weekly Portfolio Analysis 11th Octuber 2015

Markets performed vey well this week. SPX jumped +3.260% ad RUT a terrific +4.60%. YTD still on the negative side SPX -2.14% and RUT - 3.27%. Bellini YTD unchanged from next week +5.785%.

I have added two new positions to the portfolio on the Call Spread side taking advantage of the week rally.

Adding 2 Call Spread December 15, one in SPX the other at RUT, both Delta 10.

So 6 position outstanding, with one about to expire next week The positions look as follows

All of them over 90% porb of ending out the money , all we need is the markets move bear or on the sideways path on the next days.

I will not expect to get into new trades next week, just keeping an eye to the markets to defend positions if we keep moving high.

The VIX has been moving down and closed at 17 on Friday, still a good number to get decent premiums.

Russell is facing now 1170/80 area, where the last lower high is and also 200 EMA, this should work as short term resistance.

domingo, 4 de octubre de 2015

Weekly Portfolio Analysis 2nd Octuber 2015

We are coming off an oversold condition on the context of a

a) Bear Market

b) Bullish Market.

There is much debate on this out there and is not an easy answer.

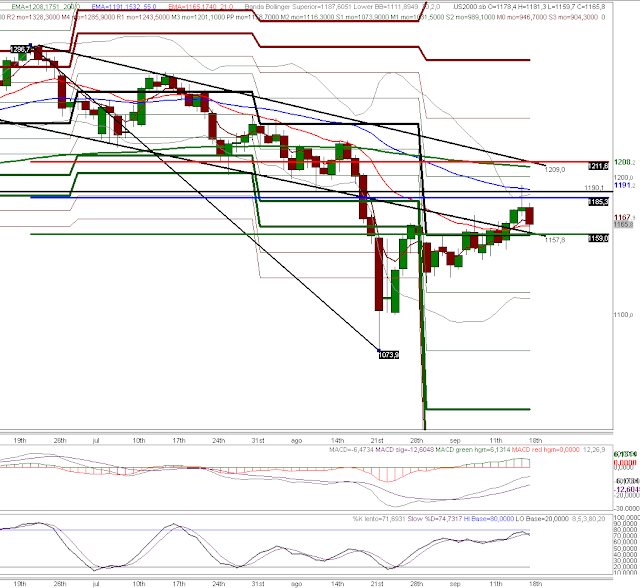

If we believe the SPX was inside an uptrend channel since Oct 2012 this has been broken to the downside as seen in the bellow chart. However the SPX has not clear made a proper lower low on the weekly side, this low is Oct 2014 one.

SPX did a decent week moving up +1.04% and Russell ended down just -0.77% SPX is YTD -5.22% while our Bellini portfolio is +5.785%

We have not been able to add any new position this week, even we where on an oversold position that could have been good opportunity to add a PS on Oct or Nov.

Current opened positions look as follows

Bull SPX Oct15 1775/85 at 0.5 looks safe now at 96% probability of success with 12 days left to expiry

Bull SPX Nov15 1560/70 at 0.4 preatty much the same at 97% of ending out the money with 47 days left.

Bull RUT Dec15 930/40 at 0.8 with 90% is the only once to be a little more concern but still looking safe.

For the week we might start to see an end of the year rally? who know but we could sell PS on any dip in the rally.

Volatility is slowing down and might get to regulat levels bellow 20

SPX has rebound from the end August lows, and might find resistance at 1960 before going to 2000 again.

RUY might find resistance at 1130 before going to 1170

@bellinimarkets.com

a) Bear Market

b) Bullish Market.

There is much debate on this out there and is not an easy answer.

If we believe the SPX was inside an uptrend channel since Oct 2012 this has been broken to the downside as seen in the bellow chart. However the SPX has not clear made a proper lower low on the weekly side, this low is Oct 2014 one.

SPX did a decent week moving up +1.04% and Russell ended down just -0.77% SPX is YTD -5.22% while our Bellini portfolio is +5.785%

We have not been able to add any new position this week, even we where on an oversold position that could have been good opportunity to add a PS on Oct or Nov.

Current opened positions look as follows

Bull SPX Oct15 1775/85 at 0.5 looks safe now at 96% probability of success with 12 days left to expiry

Bull SPX Nov15 1560/70 at 0.4 preatty much the same at 97% of ending out the money with 47 days left.

Bull RUT Dec15 930/40 at 0.8 with 90% is the only once to be a little more concern but still looking safe.

For the week we might start to see an end of the year rally? who know but we could sell PS on any dip in the rally.

Volatility is slowing down and might get to regulat levels bellow 20

SPX has rebound from the end August lows, and might find resistance at 1960 before going to 2000 again.

RUY might find resistance at 1130 before going to 1170

@bellinimarkets.com

sábado, 26 de septiembre de 2015

Weekly Portfolio Analysis 26th September 2015

Bears are across the martket, and selling Credit Spreads is what I have been trying all week, but either my strikes were too far or I was asking for too much premium. At the end no Call Spread is added to my portfolio. However I have added a preatty out of the money Put Spread on SPX Nov15 1560/70 for 0.40.

The portfolio still up +5.785% YTD while SPX is down -6.20%. The week has been very bearish but not in panic mood. SPX is down -1.36% week and RUT a big -3.77% down for the week.

We have now 3 open positions each Oct, Nov and Dec expiries. All looking safe over 89% prob of succeed, hopefully we will not have to adjust this week any of them.

SPX is heading South along with VIX heading North. VIX is rebounding at support zone

SPX could be in the road to 1740 target, as Fib Expansion from the 2000 retracement zone

SPX Weekly Chart

Russell is looking even more Bearish, with a first target to 1075.

The portfolio still up +5.785% YTD while SPX is down -6.20%. The week has been very bearish but not in panic mood. SPX is down -1.36% week and RUT a big -3.77% down for the week.

We have now 3 open positions each Oct, Nov and Dec expiries. All looking safe over 89% prob of succeed, hopefully we will not have to adjust this week any of them.

SPX is heading South along with VIX heading North. VIX is rebounding at support zone

SPX could be in the road to 1740 target, as Fib Expansion from the 2000 retracement zone

SPX Weekly Chart

Russell is looking even more Bearish, with a first target to 1075.

domingo, 20 de septiembre de 2015

Weekly Portfolio Analysis 20th Septemeber 2015

Spain just won the EuroBasket and need to thank this wonderful team for bringing the cup once more time, thank you guys you are incredible, in the game and out the arena.

September cycle is finally over, and we have suffeedr a lot the last 4 weeks. The portfolio gets a red -2.59% for the month. However still a decent year, The Portfolio is up +5.785% for 2015 while the SPX has a poor -4.90%.

I'm looking to add positions in Octuber and November. Defently is the right time for a November Iron Condor, looking both SPX lets say 2120 - 1670 and RUY 1240 - 980.

Also looking to get filled on Oct Call Spreads. I have been trying RUT 1270/80 Nov15 but have not been filled.

Our outstanding positions are as follows:

Just 2 positions in the books

Octuber15 SPX 1775/1785 has 89% prob ending out of the money, so no concern here

December15 RUT 940/930 has 92% prob ending out the money, as well no concern so far.

Markets are still in Risk off mood. I still see bearish on the charts in the shot term. Index VIX still look high at 22.8.

RUT and SPX are still moving on the Fib retracements of the bearish movement down.

SPX has resistance at 2000 and first support at 1900.

Same Russell 2000, with big resistance at 1190

@bellinimarkets.com

September cycle is finally over, and we have suffeedr a lot the last 4 weeks. The portfolio gets a red -2.59% for the month. However still a decent year, The Portfolio is up +5.785% for 2015 while the SPX has a poor -4.90%.

I'm looking to add positions in Octuber and November. Defently is the right time for a November Iron Condor, looking both SPX lets say 2120 - 1670 and RUY 1240 - 980.

Also looking to get filled on Oct Call Spreads. I have been trying RUT 1270/80 Nov15 but have not been filled.

Our outstanding positions are as follows:

Just 2 positions in the books

Octuber15 SPX 1775/1785 has 89% prob ending out of the money, so no concern here

December15 RUT 940/930 has 92% prob ending out the money, as well no concern so far.

Markets are still in Risk off mood. I still see bearish on the charts in the shot term. Index VIX still look high at 22.8.

RUT and SPX are still moving on the Fib retracements of the bearish movement down.

SPX has resistance at 2000 and first support at 1900.

Same Russell 2000, with big resistance at 1190

@bellinimarkets.com

Suscribirse a:

Entradas (Atom)