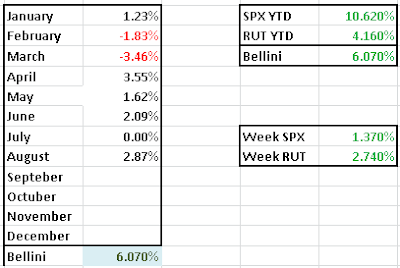

The year started with a bad 1Q, -4% resul that was well managed ending 3Q with a healthy +10% YTD.

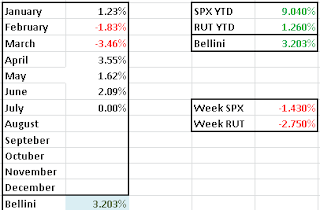

However 4Q was a terrible quarter mainly due to the strengh of the american market, and the wrong strategy of selling CALL SPREADS instead of selling PUT SPREADS.

Final result is -1.135% 2017.

If we compare the result with SPX +19.42% looks like a poor 2017 strategy.

Will keep educating in order to be able to trade as succesfull as one of my inspirations @lazytrading and recently joined his LT Options Course

https://ltoptions.com

Currently have no open trades for 2018, needed to recover my trading emotions after current losses. Expect a bullish 201 as well, but markets will consolidate at one point where most od my trading should be done.