Against the odds the US Index maintain their bullish momentum.

But nothing will keeps moving up forever. That makes a threat to our Call Spreads January 2275/2300 at 23 Deltas.

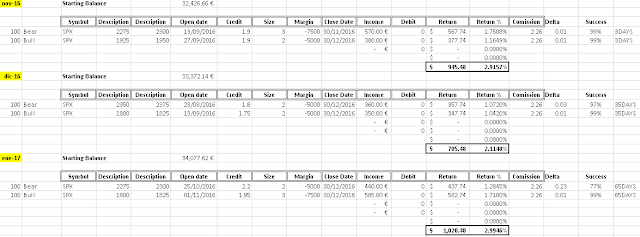

Next weekend November cycle will be over, and portfolio would show a modest +3.25% returned if it is compared to SPX +8.29% and the amazing RTY +18.60% YTD.

On our portfolio everythig looks safe apart from the january Call Spread. I think could be now a good spot to close both Dec and Jan 1800/25 Put Spreads.

The SPX Index is in free raise, there is nothing to stop it, apart from a healthy movement of consolidation needed. My objetive is to reach 2300 in the following weeks.

domingo, 27 de noviembre de 2016

domingo, 13 de noviembre de 2016

Weekly Portfolio Analysis 13th November 2016

Trump is the new president of the greatest nation in earth and the US markets are .... going UP. After the initial shock in the rest of the world the US has experienced a non seen strength ever. Russell 2000 is up 12% YTD after a 10% raise this week!!!

Our 3 Iron Condors are all looking good apart form the Call side on the January31th 3 SPX 2275/2300 showing a small lost at 14 Deltas.

$VIX has experience big volatility lately, and might continuous this path in the weeks ahead.

Now show low volatility again, perfect zone to start raising once more time.

The chart of the year on my opinion is $RUT. Not only shows a 12% raise YTD, looking at the weekly chart I wo'nt be surprise if in 2017 confirms this HCH and get to 1450 levels projection.

Our 3 Iron Condors are all looking good apart form the Call side on the January31th 3 SPX 2275/2300 showing a small lost at 14 Deltas.

$VIX has experience big volatility lately, and might continuous this path in the weeks ahead.

Now show low volatility again, perfect zone to start raising once more time.

Suscribirse a:

Entradas (Atom)