Against the odds the US Index maintain their bullish momentum.

But nothing will keeps moving up forever. That makes a threat to our Call Spreads January 2275/2300 at 23 Deltas.

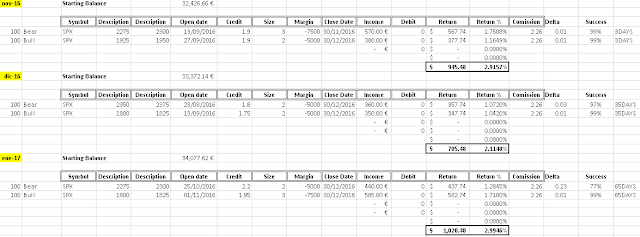

Next weekend November cycle will be over, and portfolio would show a modest +3.25% returned if it is compared to SPX +8.29% and the amazing RTY +18.60% YTD.

On our portfolio everythig looks safe apart from the january Call Spread. I think could be now a good spot to close both Dec and Jan 1800/25 Put Spreads.

The SPX Index is in free raise, there is nothing to stop it, apart from a healthy movement of consolidation needed. My objetive is to reach 2300 in the following weeks.

No hay comentarios:

Publicar un comentario