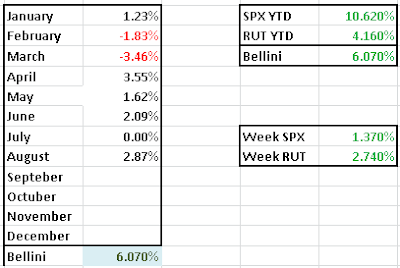

Markets are still doing great SPX YTD 12.53% and RTY is up +9.85%. Bellini is doing well, +10.304% after adding 4.23% on the last 4 weeks.

We received maximum Premium on Put Spread 2275/2300 and we closed two Credit Spreads Sep 2550/2575 at 0.4 and Oct 2575/2600 at 0.35.

We have also opened new spreads for November and December cycles.

Latest movement up at 2519 is getting in trouble CS Nov30 2575/2600. we have also opened PS at 2350/75 to help protect the CS.

Volatility is at its lows once again, supporting the idea of a stop and breath to the market