We added nice 2.12% we last week expires to the portfolio making a nice +8.314% YTD for 2018.

Markets seem to go easy for the rest of the year after a strong week +4.85%.

December trades only one Put Spread open, far out the money looking very safe

No intention on adding positions for December, will look to add first January trades on the 10 Deltas next week, still $VIX has not tumbled

domingo, 2 de diciembre de 2018

sábado, 3 de noviembre de 2018

Options Strategy Monthly Analysis 2nd November 2018

I would like to say I saw it coming. Again, another Octuber, markets SOLD-OFF.

I had only one position in RUT OCT PS 1550/1560at 0.7 that had to defence closing it at 2.04. When I enetered this trade the RUT was marking oversold condition already, but in the next 3 weeks the index dropped another 12%

Currently both SPX and RUT are in positive for the 2018 but poorly

We dont know if we are on the start of a Bear market, but have taken the opportunity to credit with more PS in Nov and Dec, all markets were oversold and VIX in max.

I expect the markets to consolidate around current levels for next week, my positions look safe so far.

I had only one position in RUT OCT PS 1550/1560at 0.7 that had to defence closing it at 2.04. When I enetered this trade the RUT was marking oversold condition already, but in the next 3 weeks the index dropped another 12%

Currently both SPX and RUT are in positive for the 2018 but poorly

We dont know if we are on the start of a Bear market, but have taken the opportunity to credit with more PS in Nov and Dec, all markets were oversold and VIX in max.

I expect the markets to consolidate around current levels for next week, my positions look safe so far.

domingo, 2 de septiembre de 2018

Options Strategy Monthly Analysis 2nd September 2018

Summer is coming to an end and so our two Put Spreads deployed at the begining of the month giving us a nice 1.839% gain to our 2018 performance.

So SPX 2018 YTD is 8.52% and Bellini is close by at 8.079%. So far so good, market is playing neutral with a bullish bias. We would need to see a bit of selling before deploying any new Put Spread. Not feeling confident on initiating a Casll Spread either, as if market keeps going up could be painful to defend.

There is no positions opened

Planning for the week is only entering new positions is Stochastics point a bit down in nearing 50, and VIX going up to the 16s

So SPX 2018 YTD is 8.52% and Bellini is close by at 8.079%. So far so good, market is playing neutral with a bullish bias. We would need to see a bit of selling before deploying any new Put Spread. Not feeling confident on initiating a Casll Spread either, as if market keeps going up could be painful to defend.

There is no positions opened

Planning for the week is only entering new positions is Stochastics point a bit down in nearing 50, and VIX going up to the 16s

domingo, 5 de agosto de 2018

Options Strategy Monthly Analysis 5th August 2018

Only six months ago we were talking of where the support would held the sharp fall of the SPX. Now the index is at two tics of making new highs ever.

After Friday movements SPX is looking determined to achieve 2900

We have only played Put Spreads on a very conservative way this year, and will continuo to do so. July is over and we received full premium on the PS 2555/65 SPX at 0.7 opnend 3rd july.

These week we have opened two new positions both in the August cycle. Both are 10 Delta and just four weeks to expiration.

Looking to VIX market has still room to go up, as the volatility index has room to keep falling

After Friday movements SPX is looking determined to achieve 2900

We have only played Put Spreads on a very conservative way this year, and will continuo to do so. July is over and we received full premium on the PS 2555/65 SPX at 0.7 opnend 3rd july.

These week we have opened two new positions both in the August cycle. Both are 10 Delta and just four weeks to expiration.

Looking to VIX market has still room to go up, as the volatility index has room to keep falling

domingo, 3 de junio de 2018

Options Strategy Monthly Analysis June 3rd 2018

Even for a passive options seller investor is hard to find time to sit down in front of the computer and write during ten minutes over the weekend..

Markets have been up and down over last two months, giving opportunities to sell options well far out the money.

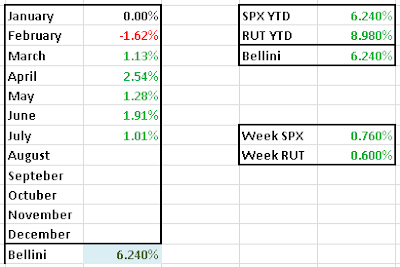

Our performance is modest but in line with SPX, however the Russell, is making great performance.

Currently have only one open trade, June 2350/2375 looking safe, not much baby sitting there, hopefully

Neeed to start looking for adding a July expiry put spread, around 2500 should be the strike.

Markets have been up and down over last two months, giving opportunities to sell options well far out the money.

Our performance is modest but in line with SPX, however the Russell, is making great performance.

Currently have only one open trade, June 2350/2375 looking safe, not much baby sitting there, hopefully

Neeed to start looking for adding a July expiry put spread, around 2500 should be the strike.

lunes, 19 de marzo de 2018

Options Strategy Monthly Analysis 19th march 2018

A lot of volatility happened after last site entry. $VIX hiked levels not seen in years.

We start opening positions once market started moving down, however we have to adjust Mar 2630/2640 PS with a -3.529% lost.

Currently we have April 2350/2360 PS looking very safe, the idea is to close position at -0.05 and open a new April PS to cash some more premium

Momentum wise market seems a bit overbought, not the best timing to open May PUT SPREADS.

We start opening positions once market started moving down, however we have to adjust Mar 2630/2640 PS with a -3.529% lost.

Currently we have April 2350/2360 PS looking very safe, the idea is to close position at -0.05 and open a new April PS to cash some more premium

Momentum wise market seems a bit overbought, not the best timing to open May PUT SPREADS.

domingo, 4 de febrero de 2018

Options Strategy Monthly Analysis 4th February 2018

Finally $VIX waked up from its long lethargy.

We have been waiting to see the levels on $VIX to start opening Put Spreads, as we have been so killed by Credit Call Spreads in 2017 we were not going to play that game for a while.

We entered on Tuesday our first Credit Spread, not the best timing as we should wait a few days but if we knew the future we were alreadty retired and spending winter in Naples Florida.

We entered March 23 PS 2630/40 at 0.8, now need a bit of babysitting as Friday Risk off send this position to 23 Deltas. Still got 48 days for expiration so we would adjust once SPX closes bellow 2715.

On Friday markets sold off and we took opportunity opening February postitions both in $SPX and $RUT.

$SPX Feb 23 2560/70 at 0.5 with 10 Deltas and just 20 days for expiration and $RUT 1450/60 Feb 23 at 0.77 also at 10 Deltas. We will adjust the SPX if closes bellow 2700 and the Russell if goes beloow 1500.

We have interest on opening also a new position in April taking oportunity of high volatility. I beieve markets are having a healthy small corretion after such a storng move up.

Russell 2000

We have been waiting to see the levels on $VIX to start opening Put Spreads, as we have been so killed by Credit Call Spreads in 2017 we were not going to play that game for a while.

We entered on Tuesday our first Credit Spread, not the best timing as we should wait a few days but if we knew the future we were alreadty retired and spending winter in Naples Florida.

We entered March 23 PS 2630/40 at 0.8, now need a bit of babysitting as Friday Risk off send this position to 23 Deltas. Still got 48 days for expiration so we would adjust once SPX closes bellow 2715.

On Friday markets sold off and we took opportunity opening February postitions both in $SPX and $RUT.

$SPX Feb 23 2560/70 at 0.5 with 10 Deltas and just 20 days for expiration and $RUT 1450/60 Feb 23 at 0.77 also at 10 Deltas. We will adjust the SPX if closes bellow 2700 and the Russell if goes beloow 1500.

We have interest on opening also a new position in April taking oportunity of high volatility. I beieve markets are having a healthy small corretion after such a storng move up.

Russell 2000

Suscribirse a:

Entradas (Atom)