After Friday movements SPX is looking determined to achieve 2900

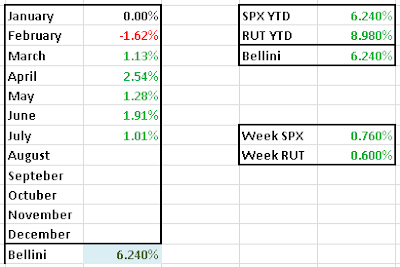

We have only played Put Spreads on a very conservative way this year, and will continuo to do so. July is over and we received full premium on the PS 2555/65 SPX at 0.7 opnend 3rd july.

These week we have opened two new positions both in the August cycle. Both are 10 Delta and just four weeks to expiration.

Looking to VIX market has still room to go up, as the volatility index has room to keep falling

No hay comentarios:

Publicar un comentario