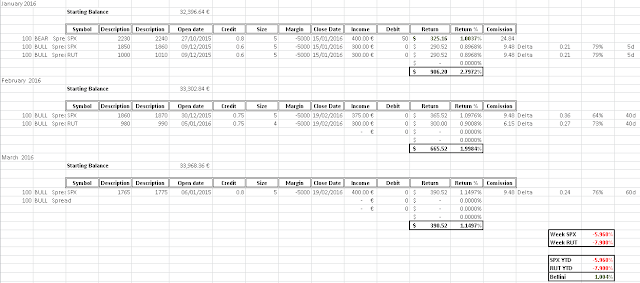

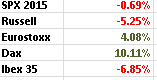

SPX is up +1.41% for the week and RUT up +0.71%. YTD SPX is down -7.57% and RUT-10.14%. Bellini portfolio shows a poor -8.507%

I was praying (not good for trading) markets will bounce at 1812 where a 200 EMA on a weekly chart plus the 2014Oct lows could be a massive support. My March positions were showing 35 deltas and everthying was pointing to stop loss and add more grief to 2016.

I didnt fell adding more risk to the downsize after suffering so much, but wanting some exposure in case we head up a bir, the dead cat bounce, so I bought 2 SPY April 202 Calls for 1.43

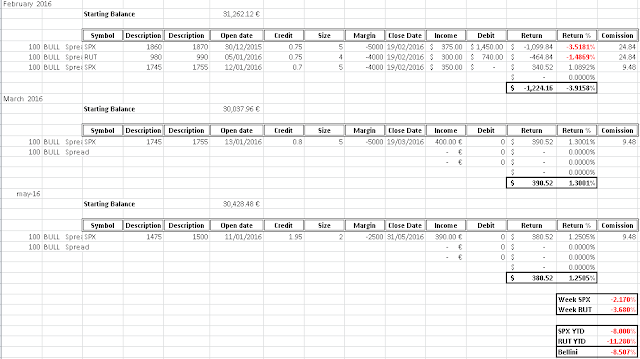

5 SPX Feb15 PS 1745/55 credit 0.7 with 13 deltas and 87% of success. 7.95% bellow current markets levels and 27 days from expiry. Safer than last week.

5 SPX Mar15 PS 1745/55 credit 0.8 with 20 deltas and 80% of success. 7.95% bellow current markets levels and 55 days from expiry. We have to keep an eye on it.

2 SPX Mayo 31st PS 1475/1500 credit 1.95 with 9 deltas and 91% of success and 21% ddistance to be ITM, and 129 days left to expiry, looking ok.

$VIX has stoped it up movement

SPX has found support, and we expect a correction back up to fib levels from last swing.

RUT also completed 3 down movements and we expect some bull movements in the following weeks.