Very strange week for the SPX, moving in a narrow range from 2154 to 2170. There is no apparent reason for the markets to fall. The markets look bullish.

Despite this sentiment, still with the same last week positions, all bearish.

The SPX 2225/50 is my biggest concern, just 2.45% of being in the money and Delta 25. I promised to close it last week and didnt, Always that wrong sense the markets have to correct, they will but not when I want.

That must be my trading plan for the week. Close the CS acept the losses and add a new further OTM in order to minimise the loss.

Vix at 11 made another very low level

sábado, 30 de julio de 2016

domingo, 24 de julio de 2016

Weekly Portfolio Analysis 24th july 2016

Keep calm and carry on bullish. Markets dont give us any sign of bearishness.Our Call Spreads are bleeding and adjustments are now a must.

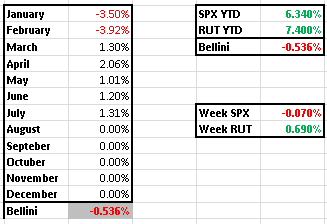

SPX has a good +6.41% YTD and RTY is +6.78%. Bellini keeps on -0.536% for not much longer tho.

According to the Delatas and distance to the market levels our positions are in danger terrotory.

August16

2 SPX CS 2250/2275 at 1.8 with 9 Deltas and 39days to expiry. Close Watching

5 RUT CS 1270/80 at 0.95 with 10 Deltas and 35 days to expiry. Close watching

September16

2 SPX 2225/2250 at 1.95 with 28 Deltas need an adjustment, thinking on selling CS 2300/25 at 1.90 to erase the losses

Octuber16

2 SPX 2275/2300 at 1.9 with 18 Deltas need a very close watching.

SPX is crying for a retracement to keep a healthy upside, but who knows what the future holds

SPX has a good +6.41% YTD and RTY is +6.78%. Bellini keeps on -0.536% for not much longer tho.

According to the Delatas and distance to the market levels our positions are in danger terrotory.

August16

2 SPX CS 2250/2275 at 1.8 with 9 Deltas and 39days to expiry. Close Watching

5 RUT CS 1270/80 at 0.95 with 10 Deltas and 35 days to expiry. Close watching

September16

2 SPX 2225/2250 at 1.95 with 28 Deltas need an adjustment, thinking on selling CS 2300/25 at 1.90 to erase the losses

Octuber16

2 SPX 2275/2300 at 1.9 with 18 Deltas need a very close watching.

SPX is crying for a retracement to keep a healthy upside, but who knows what the future holds

domingo, 10 de julio de 2016

Weekly Porfolio Analysis 9th July 2016

As expected markets went up strongly. SP500 closes at 2.129 and Russell2000 at 1,177.

Bellini portfolio still -0.536%, doing worst than the benchmark SPX +4.210%, but recovering from begining of year losses.

I entered two new bearish trades this week, as I considered markets were on oversold condition

Although the SEP call spread were nor executed at the strike expected, as it was 2250/75 but mistakes happens.

Now this September Call Spread lookes a bit stressed with 15 deltas.

All the remaining positions looking OK with less than 10 Deltas

$VIX fell sharply indicating the fears are out after the stong NFP, however we are yet on resistance and either a move up and then a pullback or some movement down would be expected next week.

sábado, 2 de julio de 2016

Weekly Portfolio Analysis 2nd July 2016

Surpricingly markets went up for the week, USA almost gaining all the Brexit losses. SPX gained 3.22% on the week and is now in positive territoru in 2016 + 2.89.

June expirations is over and I added 1.203% to our performance receiving full premium on the SPX 2175/2200.

On top of that I closed earler the SPX 2200/2225 july 30th at 0.4 originally sold at 2.5 so adding another 1.31% to the portfolio.

Currently only opened August CS

July 30th SPX 2 2250/2275 sold at 1.8 Delta 3 and 60 days to expiry

July 19th RUT 1270/1280 sold at 0.95 Delta 4 and 48 days to expiry

Markets are gaining upside momentum with VIX returning to low levels

SPX is on the long resistance over past few months, not right time to open PS and also think if the levels are broken we could see further movements up.

June expirations is over and I added 1.203% to our performance receiving full premium on the SPX 2175/2200.

On top of that I closed earler the SPX 2200/2225 july 30th at 0.4 originally sold at 2.5 so adding another 1.31% to the portfolio.

Currently only opened August CS

July 30th SPX 2 2250/2275 sold at 1.8 Delta 3 and 60 days to expiry

July 19th RUT 1270/1280 sold at 0.95 Delta 4 and 48 days to expiry

Markets are gaining upside momentum with VIX returning to low levels

SPX is on the long resistance over past few months, not right time to open PS and also think if the levels are broken we could see further movements up.

Suscribirse a:

Entradas (Atom)