After a quiet year Markets collapsed on Monday. Black Monday, Things could have been worst, but disaster

came to reality, and all Index across the world plunged.

SPX made a low on 1868.1 just 18 points

away my 1840/50 Sep15 Put Spread. Same situation at Russell 2000. VIX touched

53.3!

We knew there were some trouble ahead but

not that panic blowing out most of achievements.

At the end of the week things got a bit

better with SPX closing up +0.91%

and RUT +0.72%.

I had to make some adjustments, but with

the panic and some IT issues I did not act according to plan. Does anyone know how to see Deltas on IB phone app?

I could not log in till an hour after marketet opened on NY, That was goog as they recovered a bit I tried to close the positions showing over 30 Delta. I could not opened new ones, first because I did not have enough funds and second due to the trades

I open the week before, terrible mistake, and also because I was a

bit in panic with that high volatility. I did the mistake of opening three positions the

week earlier when things started to get nasty and that kept me away from opening

and exposing myself further.

So SPX Sep15 1840/50 opened

at 0.45 was closed at 2.5 making a loss to the portfolio of -3.098%.

Then RUT Sep15 1040/50 opened at 0.60 was

closed at 1.944 with a 2.031 loss.

And finally RUT Oct15 1050/60 opened at 0.85 closed

at 2.08 with -1.908% loss.

Two days later I opened SPX Sep15 1745/55 at 0.55 trying to make some alpha to

mitigate the losses.

Now Bellini portfolio is only 3.246% up for

the year, and SPX is down -3.408%

This is how it looks outstanding positions

right now

With still 4 cycles to end the year

everything could happen, to gain back the losses or to get things worst. Lets

try first not to blow up the account.

VIX went completely mad, I like volatility

to open PS but not that high. A 53 on VIX was a real crash.

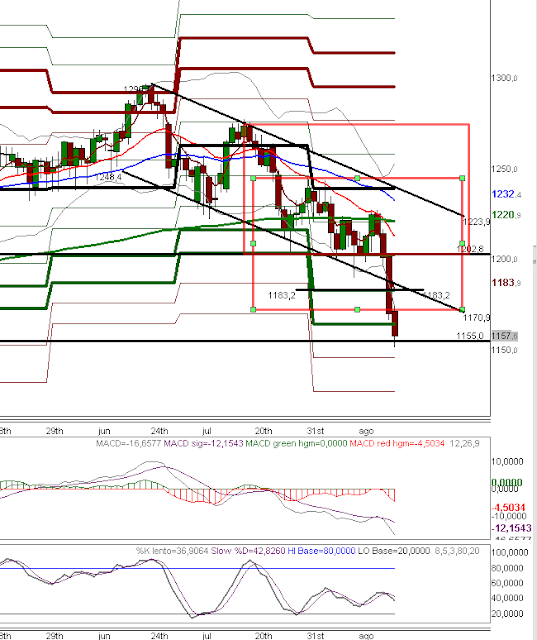

Russell 2000 broke all my targets and fell

sharply. Now has moved up and is now 50% retracement on the Fib move down,

where sellers will try to move the index down.

SP500 shows similar picture, finding now

resistance where some sellers will come out. Although oscillators are finally

showing oversold conditions I am being a bit coutios about an V formation, and

think we could have more trouble down following weeks. Hope I’m wrong and lets

see some low volatility this week.

Plan for the week not to open any Bull

trade and defend according to 2 weeks ago plan if things get nasty

@bellinimarkets.com