The week ended in strong crash mood, China, Fed, Greece all made the excuses to send the markets in big red.

SPX end the week with a -5.77% loss and RUT fall -4.43% in the same period. On the year the SPX show a poor -4.27 YTD. We have hade a very range market the whole year and the falls were kind of expected actually.

August cycle is over and my portfolio was rewarded with 1.6167%, making a good 10.283% for the year 2015.

As VIX was making new year highs I could not stop myself trying to take advantage of the volatility and added new positions to the portfolio, though the worst was still to come.

My open position looks as follows, and the Delta on the right side shows the position I better adjust and defend nex week in order to not cause much pain to my performance.

SPX Sep15 1850/60 at 23 Delta with 77% probability to ending in out the money will have to be adjusted before getting to 30 deltas. Ideally will try to open new PS Sep15 at 1690/1700 to release some pain of the adjustment.

The other position that concerns me is Oct RUT 1050/1060 with 21 Deltas and 79% porbaility ending out the money. Will try to open 940/930 Oct15 once closed the danger one.

Looking to the markets the VIX rocketed, with a 28.03 made the highest mark of the year, and a very extream number.

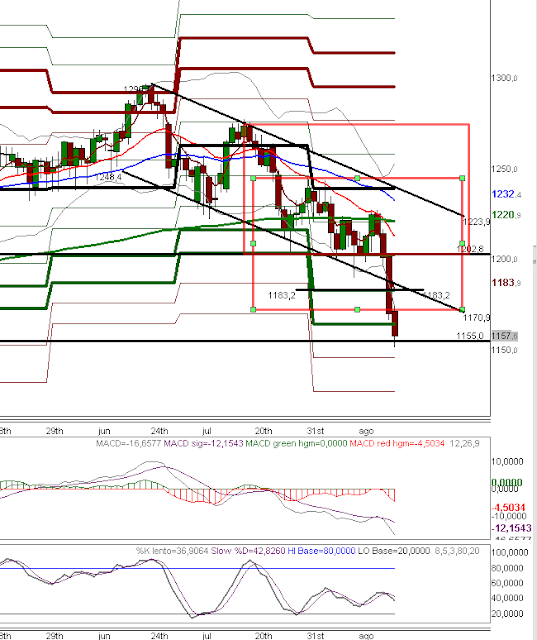

Rusell 2000 did what we said had the highest probaility last week, and fell bellow our targets.

Now sits just on the Fib 50% retracement on the last move up, and the trendline makes me believe we are going to find some support here. However the markets are falling as a knife sharp and is better no to stay in the path.

On the other hand the SP500 has break the trendline and is looking also to find support on the fib of last move.

I dont like the Stochastics, showing still room to be in oversold.

I mentioned from weeks ago I didnt like the SPX monthly chart, as the Oscilator were crossing down only seen at the end of the dot.com era and pre Lehman crisis.

Nice article man!

ResponderEliminarI do think as well, that Stochastics still needs a little work on the way down, as the second line usually has to go lower before rebounding later with conviction.

This is going to be an interesting week and it is great to have a blog like yours to consult and talk about trading with transparency.

LT

Thank you sir!

Eliminar