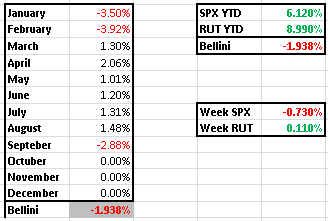

Markets made a halt in their way up after Yellen spoke. Not that much, SPX is down just -0.73% in the week but looks like a bigger one agter the past low volatility.

Our portfolio performance still lags behing major index with a -1.838% compared to the +6.12% on SP500

In 3 days we will get full premium on the Aug CS 2250/2275. but still will be in negative performance

We opened a new position on Monday on December cycle

Our current positions looks ok, if we see more dounside this week markets will be oversold and we would see opening PS

The markets are in no mans land, moving on a narrow range, still think a correction would be healthy to continiuous the bull mission.

domingo, 28 de agosto de 2016

domingo, 21 de agosto de 2016

Weekly Portfolio Analysis 21th August 2016

Markets are finding hard to keep moving up, but are not falling dow either. VIX is at its lows yet making really hard to get decent premiums in new positions

SPX is +6.85% and RUT +8.88% YTD 2016. Very decent returns. On the other hand my Bellini portfolio is down -1.938%

In ten days time looks like I will receive full credit on the CCS 2250/75, and the Oct 2275/2230 looks safe for the time being.

Looking to the SPX and RUT looks like is finding some resistance although I believe 2300 will be touch sooner than later.

I would like to exploring opening positions on SPX 1950/2350 IC zones, but due to low ViX I would have to look further on time strikes. On RUT looking strikes 1100/1350

SPX is +6.85% and RUT +8.88% YTD 2016. Very decent returns. On the other hand my Bellini portfolio is down -1.938%

In ten days time looks like I will receive full credit on the CCS 2250/75, and the Oct 2275/2230 looks safe for the time being.

Looking to the SPX and RUT looks like is finding some resistance although I believe 2300 will be touch sooner than later.

I would like to exploring opening positions on SPX 1950/2350 IC zones, but due to low ViX I would have to look further on time strikes. On RUT looking strikes 1100/1350

domingo, 14 de agosto de 2016

Weekly Portfolio Analysis 14th August 2016

After 3 weeks badly manageing the Sep 2225/50 CS finally stopped out at 6.70.

Portfolio Bellini YTD has a negative -2.233% performance 2016, wide behind major indices.

Markets did not move much this summer week. With VIX on very low zones makes difficult to sell Spreads, but will try and find well OTM to get some return this year.

Next Friday we would, hopefully, get full premium on the RUT CS 1270/80 and end of month hopefully the CS 2250/75

SPX still look very bullish and aiming to 2300

Portfolio Bellini YTD has a negative -2.233% performance 2016, wide behind major indices.

Markets did not move much this summer week. With VIX on very low zones makes difficult to sell Spreads, but will try and find well OTM to get some return this year.

Next Friday we would, hopefully, get full premium on the RUT CS 1270/80 and end of month hopefully the CS 2250/75

SPX still look very bullish and aiming to 2300

domingo, 7 de agosto de 2016

Weekly portfolio Analysis 6th August 2016

It should have been a good week releasing all the pressure on the Call Spreads. However I did not react to the bearish movement on Tuesday, then 2045 support moved the SPX to its highest zones ever.

So the positions are same as last week, with more pressure

i should have closed the september CS with very low damage but didnt, so i will pay the price this week

$VIX is in a ridiculous low level, but markets have no intention of taking a breath.

$SPX looking to reach 2300 shortly

So the positions are same as last week, with more pressure

i should have closed the september CS with very low damage but didnt, so i will pay the price this week

$VIX is in a ridiculous low level, but markets have no intention of taking a breath.

$SPX looking to reach 2300 shortly

Suscribirse a:

Entradas (Atom)