Not hedging trades when we where on over bought and low volatility conditions has been the first mistake. Opening trades when the markets where falling as a sharp knive is the second mistake. I have had to close positions after 3 days from entry.

I have to thank I close the trades as they would be now in the money and threatening to blow up the account.

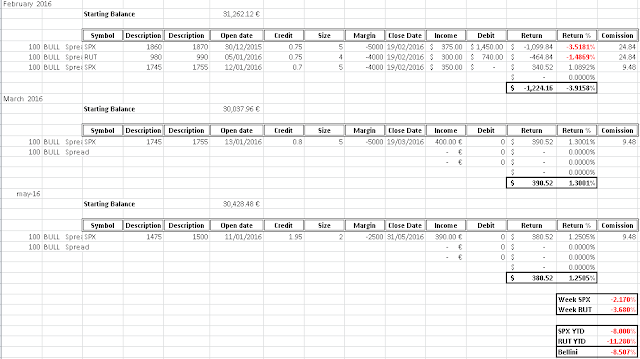

SPX fell -2.17% this week and YTD is down -8%. RUT is down -3.68% and 2015 YTD is -11.28%

Bellini is 2015 YTD -8.507% after commissions.

.

5 SPX Feb15 PS 1745/55 credit 0.7 with 20 deltas and 80% of success. 6.73% bellow current markets levels and 33 from expiry. We have to keep an eye on it.

5 SPX Mar15 PS 1745/55 credit 0.8 with 25 deltas and 75% of success. 6.73% bellow current markets levels and 61 days from expiry. We have to keep an eye on it.

2 SPX Mayo 31st PS 1475/1500 credit 1.95 with 11 deltas and 89% of success and 20% ddistance to be ITM, and 135 days left to expiry, looking ok.

Markets might be in support and a rebounce is likely. Vix, outside bolinger band is in resistance

SPX has support at 1860 and trend line from 2013.

RUT has support in 980. Has declisne 20% from Dec highs. Has been bearish with 3 clear movements, so lets say the probability of a rebound is likely now

No hay comentarios:

Publicar un comentario