Risk off across the board. The fact there is no a real reason for this sell off really worries me. Worst stock market sart of a new year ever.

Last week I was a happy camper waiting to cash in my January expires. Now I might loose on all my trades.

I opened new positions at the begining of the week with are in red now and need adjustment.

First mistakes not taking serious de sell off and not buying PUT for protections

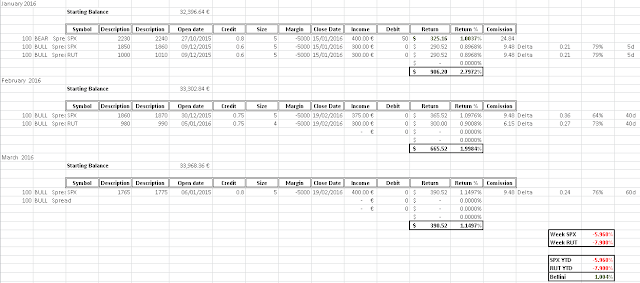

Our current opened positions looks as follows

Depending on how opens wall street on Monday we could suffer terrible looses.

January Expires in 5 days and we are with Delta 21 and just 3% of being in the money. Adjustment is needed, better to suffer a loss that to bigger regreats.

February trades are even worst, SPX 1860/70 has Delta 36 and should have been moved away last week and only 2.5% being in the money. Then RUT 980/90 with delta 27%.

March position is not better with Delta 24 and 7.6% away of being in the money.

I will try to open Feb positions in SPX once closed current ones at 1650 levels to offset looses

VIX is looking for higher levels that means further looses in the markets.

SPX is in sell off and dont see support till 1900 and then 1870 lows last summer. Current YTD -5.96%

Same RUT that is falling like a knife, -7.90% in 2016.

@bellinimarkets

We are definitely off to a bad start for the year. Hopefully the rest of January will not be this bad.

ResponderEliminar